Article Info

Market Research Firms Shouldn’t Forecast

Dell’Oro released a report indicating the Optical Transport Market grew 22% in 2005.

Great news! Except I bet they didn’t forecast even a 10% increase when they did their forward looking analysis in 2004. The last reports I saw showed straight line 4% – 6% growth. In 2004, folks were walking around talking about the suspended animation of optical transport. Mention Optical Transport to a brokerage analyst and their skin would turn white. Now, it’s 22% growth and there are not many folks out there saying ‘I told you so’.

People familiar with Telecom forecasting (particularly anyone who read a forecast report in 2000) know the track records of the big firms in this area are not good. The aftermath of the late-90′s bubble brought additional metrics and accountability to the securities business but nothing really changed at the market research firms.

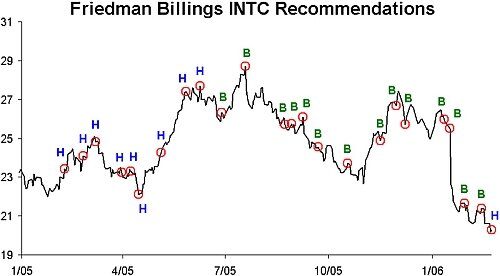

For instance, we can see the entertaining history of one analysts (Friedman Billings) Intel (INTC) recommendations (Courtesy SeekingAlpha and TickerSense).

Aha. Liked it at 29 last August, but doesn’t like it as much six months later at 20.

Why don’t we see the same metrics on market research forecasts? If I was a big buyer at Cisco, Intel, etc. I would demand to see this information.

The Stalwart highlights this same issue today in a related post that talks about what the real value add should be…

Despite the fact that they employ “analysts”, the real value-added from these firms, comes from their data (e.g. marketshare info for handset shipments in q3 ’05. When you need that kind of info, it’s best to find a Gartner report). The actual insights and opinions of the individual analysts (at places like Jupiter, or even on Wall St.) is somewhat secondary.

Bingo.

With some notable exceptions (Lightreading’s Heavyreading) the predictions in market research from the mainstream firms never reveal earth-shattering truths to the market participants who would be most affected. At best, they can identify trends and risks but quantifying them is another matter entirely. Good business plans have died and horrific plans approved because of inaccurate market research forecasting. It’s silly that people who have the most information about a subject feel the need to seek an ‘independent’ though less informed source in order to make a point.

This same concept (DONT FORECAST) was also highlighted in “Seven Sins of Fund Management“, which is good reading for anyone, not just people managing money.

Trackbacks / Pingbacks